LIC's Single Premium Endowment Plan is a participating non-linked savings cum protection plan, where

premium is paid in lump sum at the outset of the policy. This combination provides financial protection

against death during the policy term with the provision of payment of lumpsum at the end of the selected

policy term in case of his/her survival. This plan also takes care of liquidity needs through its loan facility

Death Benefit:

a) On death during the policy term before the date of commencement of risk: Return of single premium excluding service tax and extra premium, if any, without interest.

b) On death during the policy term after the date of commencement of risk: Sum Assured along with vested Simple Reversionary Bonuses and Final Additional Bonus, if any.

Maturity Benefit: Sum Assured, along with vested Simple Reversionary Bonuses and Final Additional Bonus, if any, shall be payable.

Participation in profits: The policy shall participate in profits of the Corporation and shall be entitled to receive Simple Reversionary Bonuses declared as per the experience of the Corporation.

Final (Additional) Bonus may also be declared under the policy in the year when the policy results into a claim either by death or maturity on such terms and conditions as may be declared by the Corporation from time to time.

premium is paid in lump sum at the outset of the policy. This combination provides financial protection

against death during the policy term with the provision of payment of lumpsum at the end of the selected

policy term in case of his/her survival. This plan also takes care of liquidity needs through its loan facility

Death Benefit:

a) On death during the policy term before the date of commencement of risk: Return of single premium excluding service tax and extra premium, if any, without interest.

b) On death during the policy term after the date of commencement of risk: Sum Assured along with vested Simple Reversionary Bonuses and Final Additional Bonus, if any.

Maturity Benefit: Sum Assured, along with vested Simple Reversionary Bonuses and Final Additional Bonus, if any, shall be payable.

Participation in profits: The policy shall participate in profits of the Corporation and shall be entitled to receive Simple Reversionary Bonuses declared as per the experience of the Corporation.

Final (Additional) Bonus may also be declared under the policy in the year when the policy results into a claim either by death or maturity on such terms and conditions as may be declared by the Corporation from time to time.

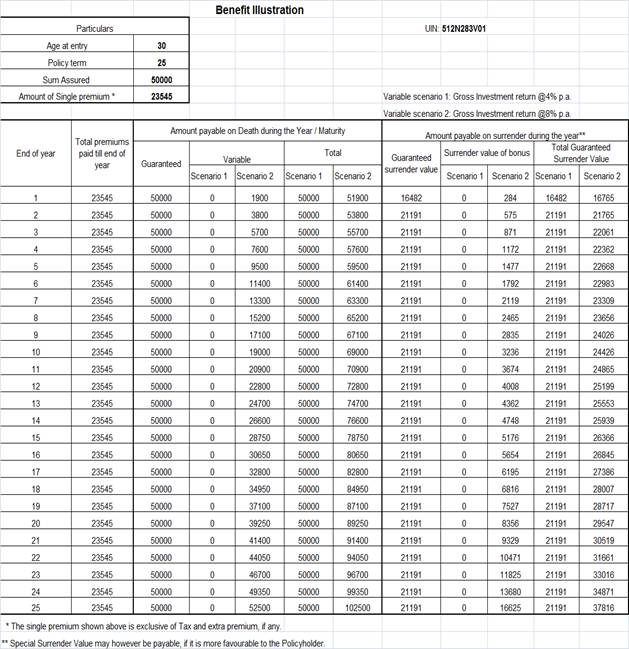

BENEFIT ILLUSTRATION:

Statutory warning:

“Some benefits are guaranteed and some benefits are variable with returns based on the future performance of the corporation. If your policy offers guaranteed returns then these will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable returns then the illustrations on this page will show two different rates of assumed future investment returns. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance.”

LIC’s Single Premium Endowment Plan

Statutory warning:

“Some benefits are guaranteed and some benefits are variable with returns based on the future performance of the corporation. If your policy offers guaranteed returns then these will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable returns then the illustrations on this page will show two different rates of assumed future investment returns. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance.”

LIC’s Single Premium Endowment Plan

ELIGIBILITY CONDITIONS AND OTHER RESTRICTIONS :

Sum Assured will be in multiples of Rs.5,000 /- only.

Date of Commencement of risk:In case the age of Life Assured at entry is less than 8 years, risk under this plan will commence either 2 years from the date of commencement or from the policy anniversary coinciding with or immediately following the attainment of 8 years of age, whichever is earlier. For those aged 8 years or more, risk will commence immediately.

Loan can be availed under this plan any time after completion of first policy year and subject to terms and conditions as the company may specify from time to time.

Buying a life insurance contract is a long term commitment. However, surrender value is available under the plan on earlier termination of the contract.

The Guaranteed Surrender Value allowable shall be as under:

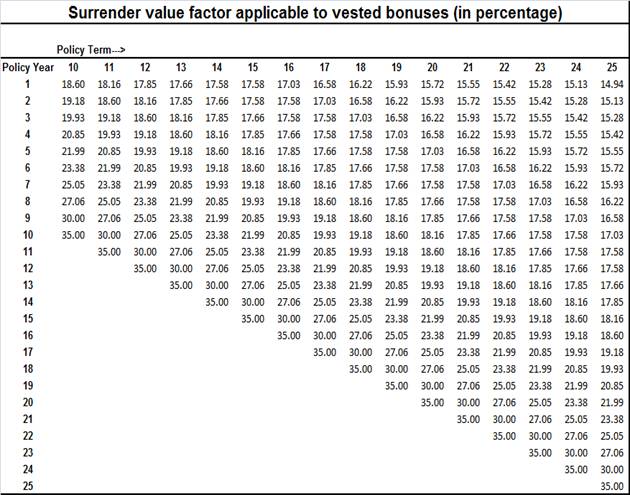

In addition, the surrender value of vested simple reversionary bonuses, if any, shall also be payable, which is equal to vested bonuses multiplied by the surrender value factor applicable to vested bonuses. These factors will depend on the policy term and policy year in which the policy is surrendered and specified as below:

Sum Assured will be in multiples of Rs.5,000 /- only.

Date of Commencement of risk:In case the age of Life Assured at entry is less than 8 years, risk under this plan will commence either 2 years from the date of commencement or from the policy anniversary coinciding with or immediately following the attainment of 8 years of age, whichever is earlier. For those aged 8 years or more, risk will commence immediately.

Loan can be availed under this plan any time after completion of first policy year and subject to terms and conditions as the company may specify from time to time.

Buying a life insurance contract is a long term commitment. However, surrender value is available under the plan on earlier termination of the contract.

The Guaranteed Surrender Value allowable shall be as under:

In addition, the surrender value of vested simple reversionary bonuses, if any, shall also be payable, which is equal to vested bonuses multiplied by the surrender value factor applicable to vested bonuses. These factors will depend on the policy term and policy year in which the policy is surrendered and specified as below:

The Corporation may, however, pay Special Surrender Value as applicable as on date of surrender provided the same is higher than Guaranteed Surrender Value.

Taxes, if any, shall be as per the Tax laws and the rate of tax as applicable from time to time.

The amount of tax payable as per the prevailing rates shall be payable by the policyholder on premiums including extra premiums, if any. The amount of Tax paid shall not be considered for the calculation of benefits payable under the plan.

If the policyholder is not satisfied with the “Terms and Conditions” of the policy, the policy may be returned to the Corporation within 15 days from the date of receipt of the policy stating the reason of objections. On receipt of the same the Corporation shall cancel the policy and return the amount of single premium deposited after deducting the proportionate risk premium for the period on cover, charges for medical examination, special reports, if any, and stamp duty.

The policy shall be void if the Life Assured (whether sane or insane) commits suicide at any time within 12 months from the date of commencement of risk and the Corporation will not entertain any claim under this policy except to the extent of 90% of the single premium paid excluding taxes and any extra premium paid.

Taxes, if any, shall be as per the Tax laws and the rate of tax as applicable from time to time.

The amount of tax payable as per the prevailing rates shall be payable by the policyholder on premiums including extra premiums, if any. The amount of Tax paid shall not be considered for the calculation of benefits payable under the plan.

If the policyholder is not satisfied with the “Terms and Conditions” of the policy, the policy may be returned to the Corporation within 15 days from the date of receipt of the policy stating the reason of objections. On receipt of the same the Corporation shall cancel the policy and return the amount of single premium deposited after deducting the proportionate risk premium for the period on cover, charges for medical examination, special reports, if any, and stamp duty.

The policy shall be void if the Life Assured (whether sane or insane) commits suicide at any time within 12 months from the date of commencement of risk and the Corporation will not entertain any claim under this policy except to the extent of 90% of the single premium paid excluding taxes and any extra premium paid.

No comments:

Post a Comment

Thank you for your comment