Introduction:

LIC’s JEEVAN NISCHAY TABLE NO. 199 (UIN : 512N258V01)

LIC's Jeevan Nischay is a single premium closed ended plan designed exclusively for our valuable policyholders like you who have at least one in force risk bearing policy with us accepted at our standard rate. You may choose the premium amount you wish to pay and the sum payable on maturity (Maturity Sum Assured) will depend on the premium amount, your age and the term selected.

1. ELIGIBILITY CONDITIONS

Minimum age at entry - 18 years (completed)

Maximum age at entry - 50 years (nearest birthday)

Policy term - 5, 7 and 10 years

Minimum Single Premium - Rs. 10,000/-

Maximum Single Premium - Rs. 10,00,000/-

(Premium shall be in multiples of Rs.1,000/-) Maximum Basic Sum Assured (First Year Death Benefit) : Lower of- Rs. 50,00,000, and 50% of total Sum Assured (total death benefit) under all existing in force policies

2. INCENTIVE FOR HIGH PREMIUM PAIDIf your premium amount is Rs. 25,000 or more, you will receive higher maturity sum assured due to available incentive.3. LOANYou can avail loan under this plan after completion of one policy year.4. SURRENDER VALUE:You may surrender the policy after it has run for at least one year. The Guaranteed Surrendered Value will be equal to 90% of the Single premium paid excluding the extra premium, if any. Corporation may however pay Special Surrender value as applicable on the date of surrender provided the same is higher than the guaranteed surrender value.5. EXCLUSIONS:Suicide: This policy shall be void if the Life Assured commits suicide (whether sane or insane at that time) at any time within one year from the date of commencement of risk and the Corporation will not entertain any other claim by virtue of this policy except to the extent of a maximum of (i) 90% of the Single Premium paid excluding any extra premium paid, or (ii) third party's bonafide beneficial interest acquired in the policy for valuable consideration (but limited to the death benefit available under this policy) of which notice has been given in writing to the branch where this policy is being presently serviced (where the policy records are kept) at least one calendar month prior to death.6. COOLING OFF PERIOD:If you are not satisfied with the "Terms and Conditions" of the policy, you may return the policy to us within 15 days.

Benefits:

A) Death Benefit:

On death during the first policy year: Five times the single premium is payable. On death during the policy term after first policy year, excluding last policy year: An amount equal to the maturity sum assured. On death during the last policy year: An amount equal to the maturity sum assured along with loyalty addition, if any.

B) Maturity Benefit:

An amount equal to the Maturity Sum Assured along with loyalty addition, if any, is payable.

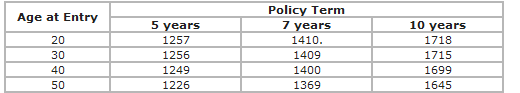

The specimen Maturity Sum Assured per Rs. 1000/- single premium is given below for some ages and terms:

LIC’s JEEVAN NISCHAY TABLE NO. 199 (UIN : 512N258V01)

LIC's Jeevan Nischay is a single premium closed ended plan designed exclusively for our valuable policyholders like you who have at least one in force risk bearing policy with us accepted at our standard rate. You may choose the premium amount you wish to pay and the sum payable on maturity (Maturity Sum Assured) will depend on the premium amount, your age and the term selected.

1. ELIGIBILITY CONDITIONS

Minimum age at entry - 18 years (completed)

Maximum age at entry - 50 years (nearest birthday)

Policy term - 5, 7 and 10 years

Minimum Single Premium - Rs. 10,000/-

Maximum Single Premium - Rs. 10,00,000/-

(Premium shall be in multiples of Rs.1,000/-) Maximum Basic Sum Assured (First Year Death Benefit) : Lower of- Rs. 50,00,000, and 50% of total Sum Assured (total death benefit) under all existing in force policies

2. INCENTIVE FOR HIGH PREMIUM PAIDIf your premium amount is Rs. 25,000 or more, you will receive higher maturity sum assured due to available incentive.3. LOANYou can avail loan under this plan after completion of one policy year.4. SURRENDER VALUE:You may surrender the policy after it has run for at least one year. The Guaranteed Surrendered Value will be equal to 90% of the Single premium paid excluding the extra premium, if any. Corporation may however pay Special Surrender value as applicable on the date of surrender provided the same is higher than the guaranteed surrender value.5. EXCLUSIONS:Suicide: This policy shall be void if the Life Assured commits suicide (whether sane or insane at that time) at any time within one year from the date of commencement of risk and the Corporation will not entertain any other claim by virtue of this policy except to the extent of a maximum of (i) 90% of the Single Premium paid excluding any extra premium paid, or (ii) third party's bonafide beneficial interest acquired in the policy for valuable consideration (but limited to the death benefit available under this policy) of which notice has been given in writing to the branch where this policy is being presently serviced (where the policy records are kept) at least one calendar month prior to death.6. COOLING OFF PERIOD:If you are not satisfied with the "Terms and Conditions" of the policy, you may return the policy to us within 15 days.

Benefits:

A) Death Benefit:

On death during the first policy year: Five times the single premium is payable. On death during the policy term after first policy year, excluding last policy year: An amount equal to the maturity sum assured. On death during the last policy year: An amount equal to the maturity sum assured along with loyalty addition, if any.

B) Maturity Benefit:

An amount equal to the Maturity Sum Assured along with loyalty addition, if any, is payable.

The specimen Maturity Sum Assured per Rs. 1000/- single premium is given below for some ages and terms:

C) Loyalty Addition:

Depending upon the Corporation's experience the policy will be eligible for Loyalty Addition on death during the last policy year or on the Life Assured surviving the stipulated date of maturity at such rate and on such terms as may be declared by the Corporation.

Benefit Illustration:

Statutory warning :

“Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your Insurer carrying on life insurance business. If your policy offers guaranteed returns then these will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable returns then the illustrations on this page will show two different rates of assumed future investment returns. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance.”

BENEFIT ILLUSTRATION :

Benefit Illustration is not available due to discontinue of the plan

Depending upon the Corporation's experience the policy will be eligible for Loyalty Addition on death during the last policy year or on the Life Assured surviving the stipulated date of maturity at such rate and on such terms as may be declared by the Corporation.

Benefit Illustration:

Statutory warning :

“Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your Insurer carrying on life insurance business. If your policy offers guaranteed returns then these will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable returns then the illustrations on this page will show two different rates of assumed future investment returns. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance.”

BENEFIT ILLUSTRATION :

Benefit Illustration is not available due to discontinue of the plan

For More details please visit here

No comments:

Post a Comment

Thank you for your comment