- LIC’s New Bima Bachat is a participating non-linked savings cum protection plan, where premium is paid in lump sum at the outset of the policy. It is a money-back plan which provides financial protection against death during the policy term with the provision of payment of survival benefits at specified durations during the policy term. In addition, on maturity, the single premium shall be returned along with Loyalty Addition, if any. This plan also takes care of liquidity needs through its loan facility.

a) BENEFITS:Death benefit:

On death during the first five policy years: Sum Assured.

On death after completion of five policy years: Sum Assured along with Loyalty Addition, if any.

b)Survival Benefits:

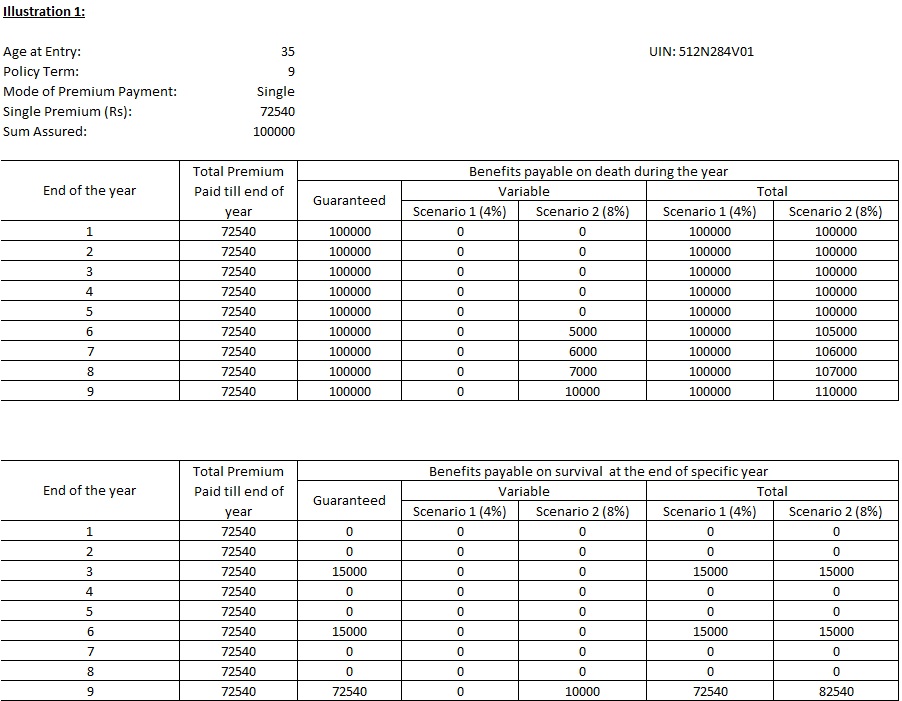

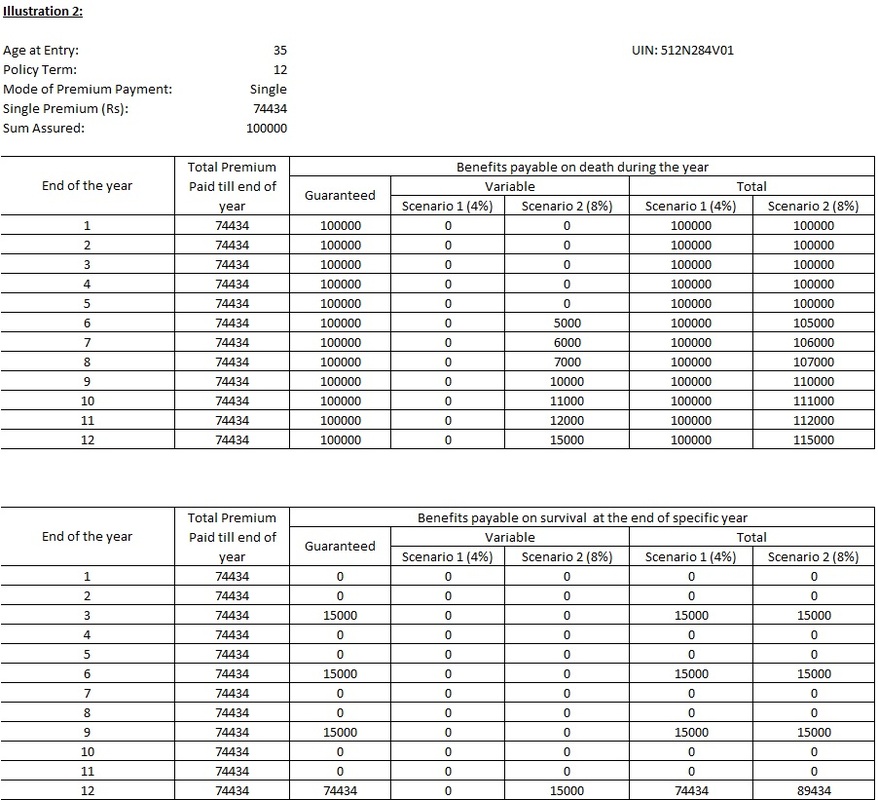

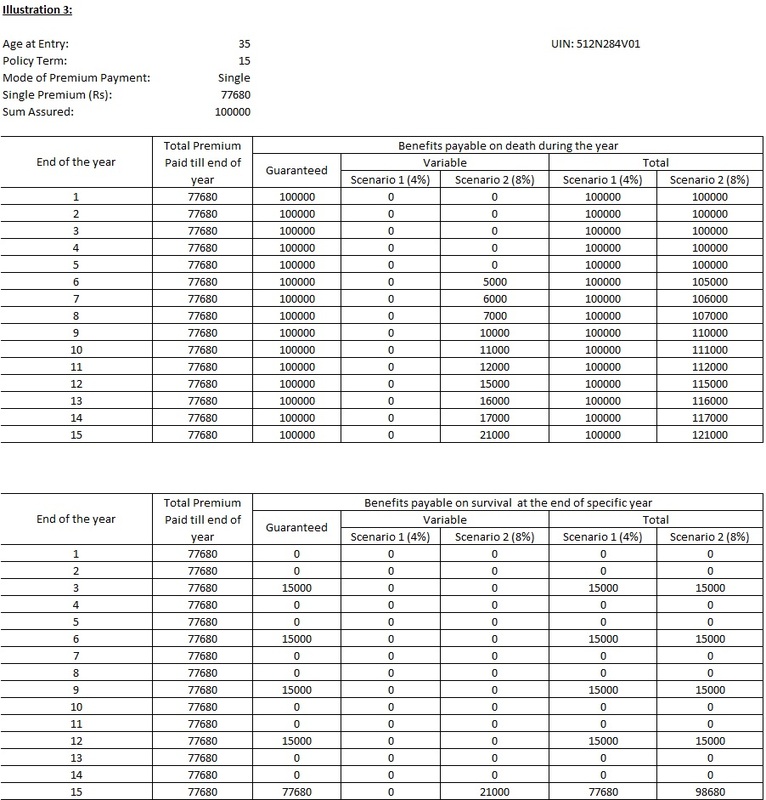

Payable as given below in case of Life Assured surviving to the end of the specified durations:

For policy term 9 years: 15% of the Sum Assured at the end of each of 3rd & 6th policy year

For policy term 12 years: 15% of the Sum Assured at the end of each of 3rd, 6th & 9th policy year

For policy term 15 years: 15% of the Sum Assured at the end of each of 3rd, 6th, 9th & 12th policy year

c) Maturity Benefit:

Payment of Single Premium (excluding taxes and extra premium, if any) along with Loyalty Addition, if any, in case of Life Assured surviving to the end of the policy term.

d) Loyalty AdditionDepending upon the Corporation’s experience the policies shall be participate in the profits and shall be eligible for Loyalty Addition. The Loyalty Addition, if any, is payable on death after completion of five policy years and on policyholder surviving to maturity, at such rate and on such terms as may be declared by the Corporation.

- Benefit Illustration:

Statutory warning:

“Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your Insurer carrying on life insurance business. If your policy offers guaranteed returns then these will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable returns then the illustrations on this page will show two different rates of assumed future investment returns. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance.”

“Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your Insurer carrying on life insurance business. If your policy offers guaranteed returns then these will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable returns then the illustrations on this page will show two different rates of assumed future investment returns. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance.”

- Notes:

- The Single Premium shown above is exclusive of tax.

- This illustration is applicable to a non-smoker male/female standard (from medical, life style and occupation point of view) life.

- The non-guaranteed benefits (1) and (2) in above illustration are calculated so that they are consistent with the Projected Investment Rate of Return assumption of 4% p.a.(Scenario 1) and 8% p.a. (Scenario 2) respectively. In other words, in preparing this benefit illustration, it is assumed that the Projected Investment Rate of Return that LICI will be able to earn throughout the term of the policy will be 4% p.a. or 8% p.a., as the case may be. The Projected Investment Rate of Return is not guaranteed.

- The main objective of the illustration is that the client is able to appreciate the features of the product and the flow of benefits in different circumstances with some level of quantification.

- v) The amount shown under benefit payable on survival at the end of the policy term is the Maturity Benefit.

- No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer: provided that acceptance by an insurance agent of commission in connection with a policy of life insurance taken out by himself on his own life shall not be deemed to be acceptance of a rebate of premium within the meaning of this sub-section if at the time of such acceptance the insurance agent satisfies the prescribed conditions establishing that he is a bona fide insurance agent employed by the insurer.

- Any person making default in complying with the provisions of this section shall be punishable with fine which may extend to five hundred rupees.

No policy of life insurance shall after the expiry of two years from the date on which it was effected, be called in question by an insurer on the ground that a statement made in the proposal for insurance or in any report of a medical officer, or referee, or friend of the insured, or in any other document leading to the issue of the policy, was inaccurate or false, unless the insurer shows that such statement was on a material matter or suppressed facts which it was material to disclose and that it was fraudulently made by the policyholder and that the policyholder knew at the time of making it that the statement was false or that it suppressed facts which it was material to disclose.

Provided that nothing in this section shall prevent the insurer from calling for proof of age at any time if he is entitled to do so, and no policy shall be deemed to be called in question merely because the terms of the policy are adjusted on subsequent proof that the age of the life assured was incorrectly stated in the proposal.

(SECTION 41 OF INSURANCE ACT, 1938):

“Insurance is the subject matter of solicitation”

- 1. ELIGIBILITY CONDITIONS AND OTHER RESTRICTIONS :

a) Minimum entry age : 15 years (completed)

b) Maximum entry age : 66 years (nearest birthday) for term 9 years

63 years (nearest birthday) for term 12 years

60 years (nearest birthday) for term 15 years

c) Maximum maturity age: : 75 years (nearest birthday)

d) Policy Term : 9, 12 or 15 years.

e) Minimum Sum Assured : Rs.35,000 for term 9 years

Rs.50,000 for term 12 years

Rs.70,000 for term 15 years

f) Maximum Sum assured : No limit

Sum Assured will be in multiples of Rs.5,000 /- only.

g) Premium payment mode : Single Premium only

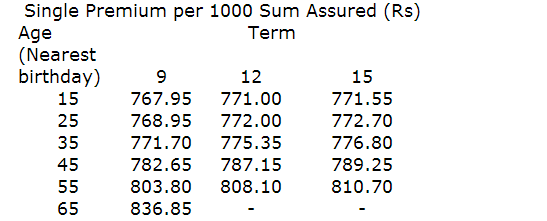

2. SAMPLE PREMIUM RATES:

The sample premium rates (exclusive of taxes) are as under: -

- 3. REBATE FOR HIGH SUM ASSURED :

High Sum Assured Rebates (As percentage of Tabular Premium) :

Term = 9 years

Less than Rs. 75,000 : NIL

Rs. 75,000 and Less than Rs.150,000 : 6 %

Rs. 150,000 and above . : 8 %

Term =12 years

Less than Rs. 100,000 : NIL

Rs. 100,000 and Less than Rs. 200,000. : 4 %

Rs. 200,000 and above : 6 %

Term =15 years

Less than Rs. 150,000 : NIL

Rs. 150,000 and Less than Rs.300,000 : 3 %

Rs. 300,000 and above : 5 %

4. LOAN :

Loan can be availed under this plan any time after completion of one policy year. The loan shall be equal to 60% of the surrender value as on date of sanction of loan.

5. SURRENDER VALUE:

Buying a life insurance contract is a long term commitment. However, surrender value is available under the plan on earlier termination of the contract.

The Guaranteed Surrender Value allowable shall be as under:

- First year: 70% of the Single premium excluding taxes and extra premium, if any.

- Thereafter: 90% of the Single premium excluding taxes, extra premium, if any and all survival benefits paid earlier.

The Corporation may, however, pay Special Surrender Value as applicable as on date of surrender provided the same is higher than Guaranteed Surrender Value.

6. TAXES:

Taxes including Service Tax, if any, shall be as per the Tax laws and the rate of tax as applicable from time to time.

The amount of tax as per the prevailing rates shall be payable by the Life Assured on the single premium including extra premium, if any. The amount of Tax paid shall not be considered for the calculation of benefits payable under the plan.

7. COOLING-OFF PERIOD:

If you are not satisfied with the “Terms and Conditions” of the policy, you may return the policy to the Corporation within 15 days from the date of receipt of the policy stating the reason of objections. On receipt of the same the Corporation shall cancel the policy and return the amount of single premium deposited after deducting the proportionate risk premium for the period on cover, charges for medical examination, special reports, if any, and stamp duty.

8. EXCLUSIONS:

The policy shall be void if the Life Assured (whether sane or insane) commits suicide at any time within 12 months from the date of commencement of risk and the Corporation will not entertain any claim under this policy except to the extent of 90% of the single premium paid excluding taxes and any extra premium paid.

No comments:

Post a Comment

Thank you for your comment